Gold IRAs enable you to diversify your retirement program, and the most beneficial companies working In this particular Area facilitate insurance coverage and safe storage, as necessary with the IRS, and be sure that the precious metals held in these accounts have to be minimum amount purity benchmarks.

The IRA account by itself is able to holding any IRA-authorized precious metals and products and solutions. The metals include; gold, silver, platinum and palladium and the solutions consist of the subsequent:

When opening a Gold IRA account, companies demand an index of costs like setup charges, once-a-year routine maintenance service fees, storage costs, transfer/rollover fees, and insurance policy service fees. It is vital to program these administration expenses out to beat the Original gold cost as part of your investment from the lengthy-term.

Our move-by-step guideline on rollovers to Gold IRAs makes the massive movement of the money anxiety-no cost and seamless. Picking out the finest Gold IRA rollover is clearer as you realize the procedures to expect.

Being familiar with a company’s mission can drop gentle about the motivations driving its pricing structure And the way they do business with customers.

Every single customer is then assigned a trusted advisor to provide steerage and training without utilizing superior-tension profits next tactics.

It been given an A+ score with the BBB and an AAA score within the BCA, and also superior ratings on numerous consumer overview Web-sites.

American Hartford Gold is very pleased that can help men and women and households guard their wealth by diversifying with precious metals.

When A serious correction occurs, investors hold the inverse possibility, to capture principal and benefit from their precious metal investments and reacquire stocks, bonds, and currencies at cut price costs. And all of this happens on the tax-totally free foundation, until it is required for retirement, when investors are in a lessen profits tax bracket.

A Gold IRA company aids you build and control your investment, while a custodian securely retains your assets and assures IRS compliance. You will get started with a company by getting in touch with them by using mobile phone or their online ask for type.

If you decide on to operate with companies not this article inside our list, It truly is critical you protect your investment by identifying red flags like hidden service fees, unapproved metals, substantial-tension income ways, or other cons in Gold IRA investments.

A gold IRA is analogous to an everyday IRA other than that the underlying asset is gold, or other precious metals in lieu of shares or other common sorts of investment assets. Which means that the returns on a lot of these investment are associated with the returns on gold (precious metals).

Deciding what sorts of products and solutions you want to buy is a good starting put as not all web pages will present all kinds of IRA-authorized precious metals.

Lear Money: Lear Capital delivers customized services for setting up Gold IRAs with around two decades of experience, like actual-time investment go right here tools and also a 24-hour danger-no cost buy guarantee, aiming to create precious metals investing transparent and obtainable.

Tatyana Ali Then & Now!

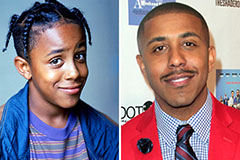

Tatyana Ali Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Tina Majorino Then & Now!

Tina Majorino Then & Now! Mary Beth McDonough Then & Now!

Mary Beth McDonough Then & Now! Sarah Michelle Gellar Then & Now!

Sarah Michelle Gellar Then & Now!